Gift Acceptance Policy

Ensuring Integrity and Stewardship in Charitable Giving

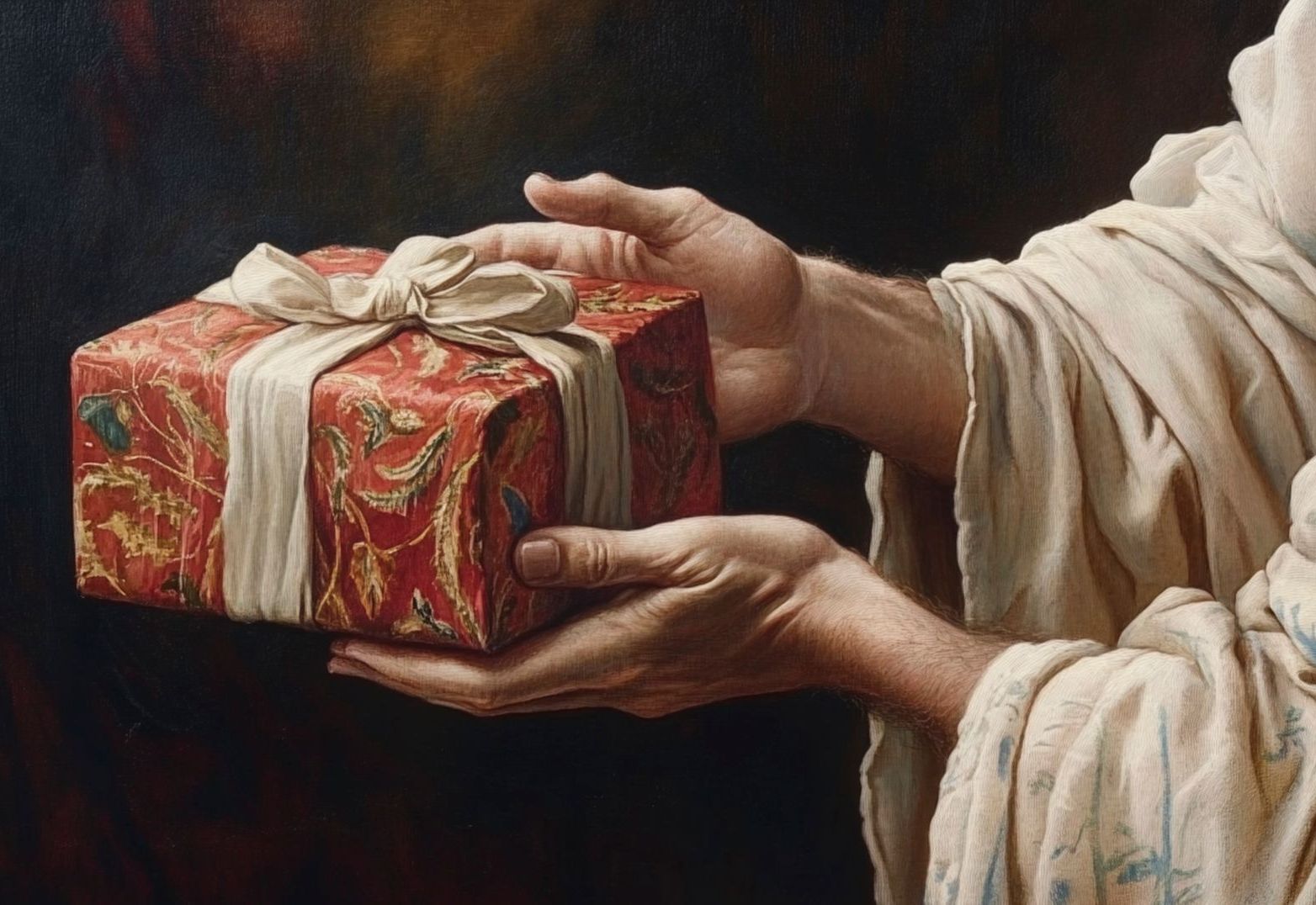

"Give and gifts will be given to you; a good measure, packed together, shaken down, and overflowing, will be poured into your lap. For the measure which you measure will in return be measured out to you."

– Luke 6:38

Gift Acceptance

The Catholic Legacy Foundation of Acadiana is committed to ensuring that every gift we receive aligns with our mission, values, and financial stewardship principles. Our Gift Acceptance Policy provides guidelines for evaluating and accepting charitable contributions while ensuring transparency, accountability, and alignment with Catholic values. Together, we can ensure your generosity creates a legacy of faith and compassion.

The Gift Acceptance Policy outlines the procedures for accepting gifts to the Catholic Legacy Foundation, ensuring that each gift is evaluated for:

- Consistency with the Foundation’s mission to perpetuate a Christ-centered future.

- Compliance with applicable laws and ethical standards.

- Financial feasibility, including any costs associated with managing or liquidating the gift.

Types of Gifts Accepted

The Catholic Legacy Foundation of Acadiana accepts a wide variety of gifts that align with its mission to support Catholic ministries, schools, and parishes.

Cash

Gifts of checks, wire transfers, and cashier’s checks are accepted (physical cash is not). Cryptocurrency gifts are reviewed case by case by the Finance Committee.

Tangible Personal Property

Includes art, collectibles, or other items that are evaluated for marketability, restrictions, carrying costs, and alignment with Catholic guidelines

Securities

- Publicly Traded Securities: Easily transferable and typically sold upon receipt, with proceeds credited to the designated fund.

- Closely Held Securities: Includes shares in privately held companies, limited partnerships, and LLCs, subject to review by the Finance Committee.

Real Estate

Developed or undeveloped properties, including those with retained life interests, if environmental and financial reviews support acceptance.

Remainder Interests in Property

Donors retain the right to occupy property for their lifetime while designating it as a gift to the Foundation upon their passing.

Bargain Sales

Properties sold to the Foundation below fair market value, enabling donors to recover their investment and receive a charitable tax deduction.

Life Insurance

Policies where the Foundation is named as both beneficiary and irrevocable owner, with valuation based on the policy’s cash surrender value.

Charitable Gift Annuities

Contracts providing fixed lifetime payments to the donor or beneficiaries in exchange for a gift of cash or marketable securities.

Charitable Remainder Trusts

Provides income to the donor or other beneficiaries for life or a term of up to 20 years, with remaining assets benefiting the Foundation.

Charitable Lead Trusts

The Foundation receives income from the trust for a specified term, after which the remaining assets are transferred to non-charitable beneficiaries designated by the donor.

Retirement Plan Beneficiary Designations & IRA Rollovers

the Foundation is the beneficiary of retirement accounts like IRAs or 401(k)s to create an endowed contribution.

Bequests

Gifts made through wills or trusts, which may specify a dollar amount, percentage, or residual balance to the Foundation.

Special Gifts: Intellectual Property, Collectibles, Royalties, and Oil and Gas Interests

Accepted with approval by the Finance Committee, ensuring compliance with financial and mission-alignment standards

Evaluation and Approval Process

Each gift is carefully reviewed by the Foundation to ensure it adheres to our guidelines:

- Mission Alignment — Gifts must support the Foundation’s mission and Catholic values.

- Financial Feasibility — Costs associated with accepting or managing the gift are considered.

- Legal Compliance — All gifts must comply with federal and state laws.

- Approval Requirements — Certain gifts, such as real estate, securities, and life insurance, require review and approval by the Foundation’s Finance Committee or legal counsel.

Commitment to Transparency and Stewardship | The Catholic Legacy Foundation of Acadiana upholds the highest standards of transparency, ethical practices, and accountability in all gift acceptance processes. We are deeply grateful for the generosity of our donors and are committed to using every gift to advance Catholic ministries, schools, and parishes.

Donor Responsibilities

Donors are encouraged to:

- Seek independent legal and financial advice regarding the tax implications of their gift.

- Provide documentation for gifts requiring appraisals, such as tangible personal property or real estate.

- Work with the Foundation to ensure that the terms of their gift are clearly documented and mutually agreed upon.

Restricted Gifts | Donors may specify how their gifts are used, provided the restrictions align with the Foundation’s mission. If a restricted gift’s purpose becomes impractical or impossible to fulfill, the Foundation may redirect the funds to a purpose closely aligned with the donor’s original intent, as permitted by law.

Start Your Legacy Today

Ready to make a gift?

For more information about our Gift Acceptance Policy or to discuss making a gift, contact us today.

Phone (337) 261-5642 | Email mtrahan@CLFAinc.org | Contact Us